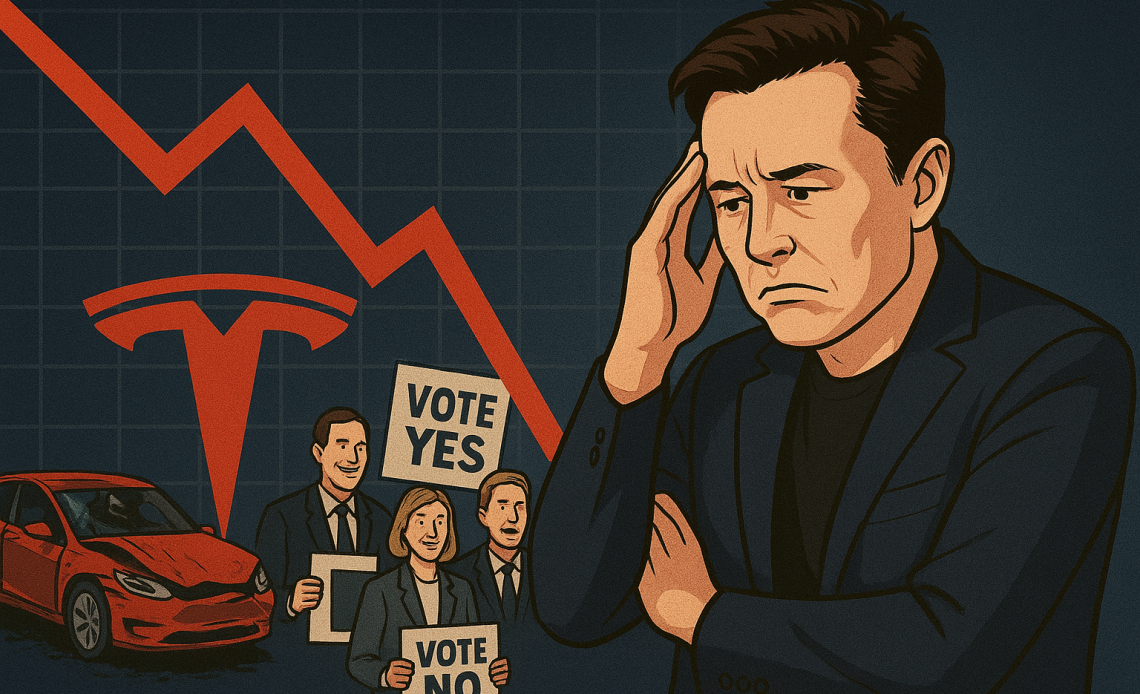

Tesla stock fell in early trading on Tuesday as investor uncertainty mounted over Chief Executive Elon Musk’s proposed $1 trillion compensation package.

The decline comes just days before shareholders vote on the plan, which has divided major institutional investors and reignited debate over Musk’s influence at the electric-vehicle maker.

The stock was down 2.6% at $456.40 in early trading. Broader market weakness added pressure, with S&P 500 futures down 1% and Dow Jones Industrial Average futures off 0.7%.

Coming into Tuesday’s session, Tesla stock was up 16% year-to-date and 93% over the past 12 months, reflecting sustained optimism around its long-term growth story despite short-term turbulence.

Norway’s Sovereign Fund rejects Musk’s pay award

The latest headwind came from Norway’s sovereign wealth fund, which said it would vote against the proposed package.

The $1.9 trillion fund, one of Tesla’s largest institutional shareholders with a 1.2% stake, cited concerns about the “total size of the award, dilution, and lack of mitigation of key person risk.”

“While we appreciate the significant value created under Mr. Musk’s visionary role, we are concerned about the total size of the award, dilution, and lack of mitigation of key person risk—consistent with our views on executive compensation,” the fund said in a statement.

The rejection introduces a degree of uncertainty into the outcome of the November 6 shareholder vote.

Musk’s plan would award him about 425 million incentive-linked shares, designed to raise his voting control to 25%, a level he has said is necessary to oversee Tesla’s artificial intelligence initiatives.

The fund had also opposed Musk’s previous pay package in 2024. Earlier this year, leaked messages revealed tensions between Musk and the fund’s chief executive, Nicolai Tangen, after Musk sent a curt message saying, “friends are as friends do.”

Divided investor base

Norway’s fund is the largest institutional investor to publicly declare its vote on Musk’s package.

Other major stakeholders, including CalPERS and the New York State Retirement Fund, have also voiced opposition.

Proxy advisory firms Glass Lewis and Institutional Shareholder Services (ISS) have recommended that shareholders reject the plan, prompting Musk to label them “corporate terrorists” during Tesla’s recent earnings call.

Not all major investors share that view. Support has come from the Florida State Board of Administration and ARK Invest’s Cathie Wood, both of whom back Musk’s leadership and the company’s AI ambitions.

The two largest shareholders, Vanguard and BlackRock, have not yet disclosed their votes.

Market sentiment remains tense ahead of the shareholder meeting. Wedbush analyst Dan Ives expects investors to approve the plan, calling it “the smart move by the Board to lay out these incentives/pay package at this key time as the biggest asset for Tesla is Musk.”

Ives rates Tesla shares Buy with a $600 price target.

Tesla sales remain under pressure

Tesla’s China-made electric vehicle sales declined 9.9% in October to 61,497 units from a year earlier, reversing a 2.8% gain in September, according to data from the China Passenger Car Association released Tuesday.

Sales of the Model 3 and Model Y vehicles produced at Tesla’s Shanghai gigafactory — including exports to Europe, India, and other markets — fell 32.3% from September.

The company’s global sales momentum has slowed as demand weakens in Europe and uncertainty lingers in the US market following the expiration of tax credits that had supported record deliveries in the third quarter.

In Europe, Tesla’s sales through September were down 28.5% compared with the same period last year amid intensifying competition from legacy automakers and new Chinese brands.

Analysts point to Tesla’s ageing model lineup and limited vehicle range as key factors behind its recent struggles in an increasingly crowded market.

The post Tesla stock down over 2% as Musk pay vote nears: what to expect? appeared first on Invezz